- Home

- Wiki

- Betting Strategies

- Kelly Criterion Strategy in Sports Betting

Kelly Criterion Strategy in Sports Betting

- 1Understanding Value Betting in Sports Betting

- 2The Formula for Determining Long-Term Profit

- 3Balancing Risk and Return

- 4Using the Kelly Strategy for Sports Betting Success

- 5Adapting the Kelly Strategy for Risk Criteria in Sports Betting

- 6Applying the Kelly Criterion in Sports Betting: Examples and Outcomes

- 7Conclusion

The Kelly Criterion financial strategy is based on value bets and helps a player determine the size of their wager on an event based on the size of their bankroll and previous results.

Understanding Value Betting in Sports Betting

A value bet is a bet on an undervalued event with a probability of outcome higher than that predicted by bookmakers.

The formula for a value bet is K x P > 1, where:

- K - is the odds;

- P - is the estimated probability of the outcome from 0 to 1.

For example, in a Europa League football match between Porto and Lazio, the odds for the home team's victory are 2.10 - a player estimates the chances of the Portuguese club winning at 60%:

K (2.10) x P (0.6) = 1.26 > 1 – this is a value bet.

The Formula for Determining Long-Term Profit

N (number of bets) x S (bet amount) x (K x P - 1).

If a player places ten identical bets of 200 $ each, a correct assessment of the outcome probability will bring a profit of 520 $ = 10 x 200 x (2.10 x 0.6 - 1).

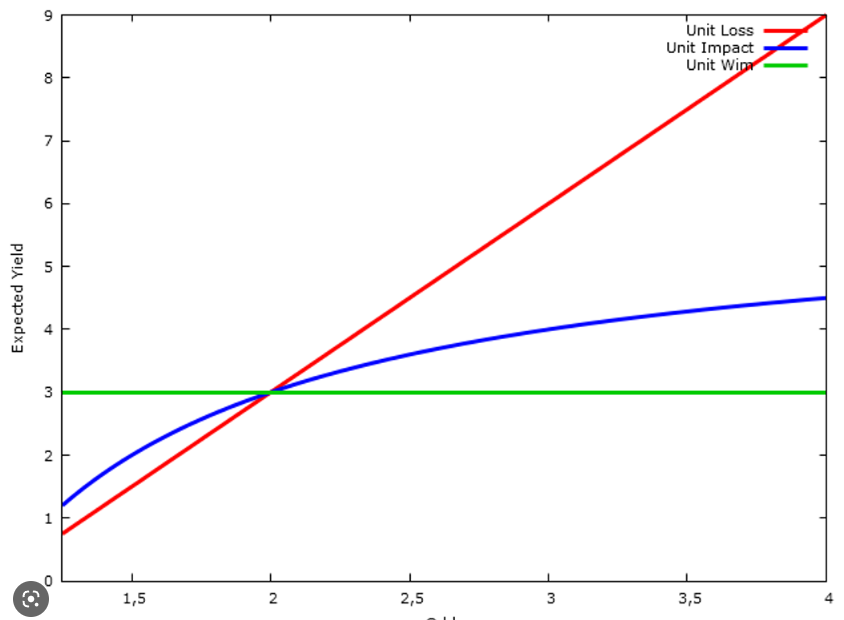

Balancing Risk and Return

When playing according to the Kelly strategy, a client of a bookmaker determines a bankroll - the amount of money for placing bets. It is impossible to bet the entire bankroll on one event, even if the bet looks like a sure thing.

The player balances between return on investment and risk. When choosing a cautious betting scheme, the bankroll grows slowly but steadily - 5-30% per month. When following an aggressive style of play, the bankroll size increases quickly - 50-200%.

But such tactics increase the risk of bankruptcy. The cautious strategy is psychologically tricky, requiring patience and emotional control.

Using the Kelly Strategy for Sports Betting Success

In the Kelly strategy, the player evaluates the percentage ratio of the opponents' strengths in each match, finds the value, and places a small portion of the bankroll.

If the user only uses the Kelly criterion and does not apply another progressive financial tactic, such as D'Alembert, Martingale or Danish systems, then to make a profit, the player needs to outplay the bookmaker by winning more than 50% of all the cases.

Adapting the Kelly Strategy for Risk Criteria in Sports Betting

The formula for determining the size of a bet according to the Kelly strategy is as follows:

Bet (%) = (K (odds) x P (forecast) - 1) / (K (odds) - 1),

where K (odds) represents the bookmaker's odds, P (forecast) is the outcome probability estimate in the format from 0 to 1, and Bet (%) is the bet amount as a percentage of the bankroll.

The player adds lowering-raising odds to adapt the formula to risk criteria (LRC). The formula then takes the form:

Bet (%) = (K (odds) x P (forecast) - 1) / (K (odds) - 1) x LRC,

where LRC is the lowering-raising odds. If LRC > 1, the bet size increases; if LRC < 1, the bet amount decreases.

However, the higher the value of LRC, the higher the risk of bankruptcy. To determine LRC, players should evaluate the possibility of the bet. For instance, if 4 out of 10 previous bets are won, then LRC = 0.4. Beginner players should use a lowering-raising odds of at most 0.25.

When playing positively according to the Kelly strategy, the size of the bet in monetary terms constantly increases. Bookmaker clients determine the bankroll size to exit the game and start a new cycle.

For example, when the size of the bankroll triples, 2/3 of the bankroll is withdrawn, and the following series of bets begin. Players rarely change LRC within a cycle.

Applying the Kelly Criterion in Sports Betting: Examples and Outcomes

In this example, the player starts with a bankroll of $10,000 and uses a Kelly criterion of 0.25 to determine the size of the bets. Let's take a look at the outcomes of the first three bets:

- In a football match between Inter and Liverpool in the Champions League, the bookmaker offered odds of 2.30 for Liverpool's victory. The player estimated the probability of the outcome at 60%, making it a value bet. The bet amount was calculated as $725 ( ((2.30 x 0.6 - 1) / (2.30 - 1)) x 0.25 x 10,000 = $725). Liverpool lost, and the player lost the bet, resulting in a net loss of $725.

- In the quarterfinals of the Olympic hockey tournament, the odds for the USA to beat Slovakia were 1.60, and the player estimated the probability of the outcome at 70%. The bet amount was calculated as $197 (((1.60 x 0.7 - 1) / (1.60 - 1)) x 0.25 x 10,943 = $197). Unfortunately, the USA lost in a shootout, resulting in a net loss of $197.

- In the semifinals of the Olympic ice hockey tournament, Finland played against Slovakia with a handicap of "-1.5", and bookmakers offered odds of 1.81 for the favourite's victory. The player estimated the probability of the outcome at 80%, making it a value bet. The bet amount was calculated as $957 (((1.81 x 0.8 - 1) / (1.81 - 1)) x 0.25 x 10,746 = $957). Finland won 2-0, earning a net profit of $775.

After the third bet, the player's bankroll increased to $11,521. The example demonstrates the potential risks and rewards of using the Kelly criterion in sports betting.

Conclusion

The Kelly Criterion is a powerful tool for bettors looking to maximise their potential returns in sports betting. However, it requires a significant amount of discipline and patience to be successful.

Bettors must accurately assess the value of each wager and be willing to make smaller bets when necessary to avoid risking their entire bankroll. Additionally, the Kelly Criterion should be used with other strategies and techniques to develop a comprehensive approach to sports betting.

With the right combination of skills and strategies, bettors can use the Kelly Criterion to achieve long-term success and profitability in sports betting.

Comments0